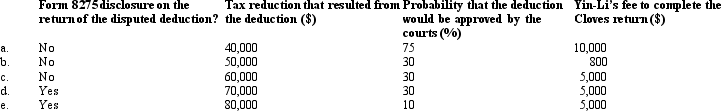

Yin-Li is the preparer of the Form 1120 for Cloves Corporation.On the return,Cloves claimed a deduction that the IRS later disallowed on audit.Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Sensory Neuron

A type of neuron that converts external stimuli from the organism's environment into internal electrical impulses.

Efferent Neuron

Neurons that carry neural impulses away from the central nervous system towards effectors such as muscles or glands.

Interneuron

A type of neuron that connects sensory and motor neurons within the central nervous system, facilitating complex reflexes.

Wernicke's Area

A region of the brain that is involved in understanding language, located in the temporal lobe on the left hemisphere for most people.

Q1: Subchapter J applies a modified _ principle

Q15: A corporate payment that qualifies as a

Q36: In a criminal fraud case,the burden is

Q91: If the maker of a promissory note

Q104: The excise tax imposed on a private

Q104: The _ tax usually is applied at

Q123: A C corporation is not subject to

Q130: Jordan owns an insurance policy on the

Q139: Journalize the following transactions of Upton Drugs:

Q152: The maturity value of a note receivable