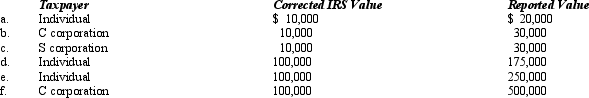

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 35%.

Definitions:

Statutory Rape

A legal term describing a sexual relationship where one participant is below the age of consent as defined by law, making the act illegal regardless of consent.

Relationship

The connection or association between two or more individuals, shaped by interactions and mutual experiences.

Extra-Familial Child Sexual Abuse

Sexual abuse of a child by someone who is not a family member, often including acquaintances, friends of the family, or strangers.

Perpetrated

The act of committing a harmful, illegal, or immoral action.

Q3: Margaurite did not pay her Federal income

Q26: The usual three-year statute of limitations on

Q52: Under P.L.86-272,which of the following transactions by

Q78: A fiduciary assigns its tax credits to

Q86: Watson Co.issued a 60-day,8% note for $18,000,dated

Q96: Receivables not currently collectible are reported in

Q97: Sixty percent of the income received by

Q130: One-third of the Hermann Estate's distributable net

Q141: Although qualified tuition plans under § 529

Q146: Sarbanes-Oxley requires sole proprietorships to maintain strong