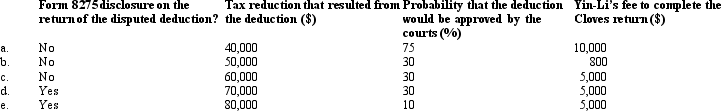

Yin-Li is the preparer of the Form 1120 for Cloves Corporation.On the return,Cloves claimed a deduction that the IRS later disallowed on audit.Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Net Operating Income

A measure of a company's profitability from its core business operations, calculated by subtracting operating expenses from revenue, excluding non-operating items such as interest and taxes.

Payback Period

The length of time it takes to recover the initial investment in a project, often used to assess the risk of investments.

Scrap Value

The projected value of an asset when it reaches the end of its operational life.

Net Operating Income

A measure of a company's profitability from regular business operations, excluding deductions of interest and taxes.

Q12: Identify the components of the tax model

Q19: Although Bowl Corporation's manufacturing facility,distribution center,and retail

Q32: Which,if any,of the following is not a

Q38: A "field audit" takes place at the

Q62: The excise tax that is imposed on

Q89: Businesses that have several bank accounts,petty cash,and

Q92: A state sales tax usually falls upon:<br>A)The

Q118: What is the justification for the terminable

Q135: To file for a tax refund,a C

Q180: Although Allowance for Doubtful Accounts normally has