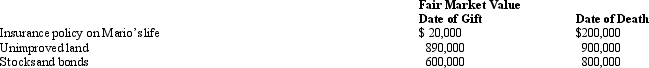

In 2007,Mario transferred several assets by gift to different persons.Mario dies in 2009.Information regarding the properties given is summarized below.  The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Mario's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Mario's gross estate must include:

Definitions:

Excise Tax

A tax on the production, sale, or consumption of a particular good or service within a country.

Efficiency

The optimal use of resources to achieve the best possible outcome or output with the least waste of time and effort.

Distort Incentives

A situation where economic or policy mechanisms result in unintended or undesirable behaviors, often leading to inefficiencies.

Income Taxes

Taxes imposed by governments on individuals or entities based on their income or profits.

Q7: For each of the following notes receivables

Q18: The bank often informs the company of

Q34: In determining state taxable income,all of the

Q40: On the basis of the following data

Q47: When a company uses the allowance method

Q64: The difference between the balance in Accounts

Q73: ForCo,a foreign corporation not engaged in a

Q91: Use tax would be due if an

Q122: Under Circular 230,a return must be signed

Q168: Outstanding checks<br>A)Added to the company's books<br>B)Subtracted from