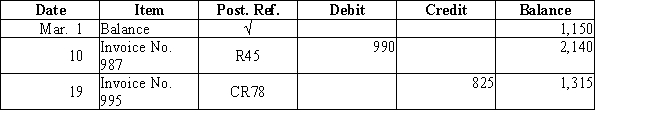

Two transactions were posted to the following customer account:NAME: Gen-X Products,Inc.Address: 123 My Way  Describe each transaction and the source of each posting.

Describe each transaction and the source of each posting.

Definitions:

Property Tax

Property tax is a levy on property that the owner is required to pay, typically levied by local governments based on the property's assessed value.

Federal Government Tax Revenue

The income collected by the federal government from taxes, which funds national expenditures such as defense, social services, and infrastructure.

Personal Income Taxes

Taxes levied on the income of individuals or families by the government.

Social Insurance Taxes

Taxes collected to fund public insurance programs, such as retirement pensions, unemployment benefits, and health insurance schemes.

Q27: Which of the following is used to

Q71: Prepaid rent,representing rent for the next six

Q76: Net income is closed to the owner's

Q100: In a multiple-step income statement,the dollar amount

Q101: The drawing account is debited in the

Q103: An adjusting entry would adjust an expense

Q142: Accrued fees earned are recorded during the

Q142: The principal ledger that contains all the

Q157: The following are selected transactions related to

Q222: Which of the following accounts has a