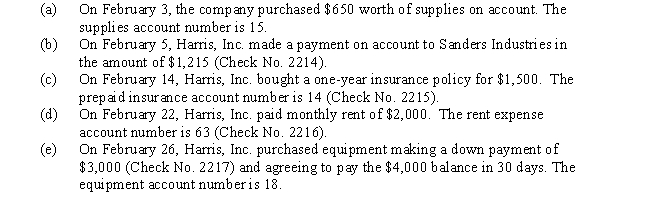

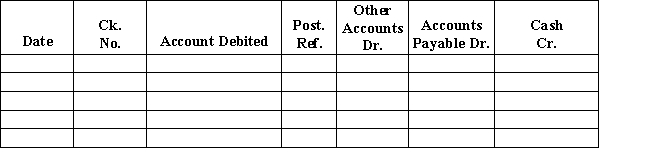

Harris,Inc.incurred the following transactions during the month of February.Record the appropriate ones in the cash payments journal.Include posting references.If a transaction should not be recorded in the cash payments journal,indicate where it should be posted.

Definitions:

501(c)(3)

A section of the U.S. tax code that provides exemption from federal income tax for nonprofit organizations considered charitable, religious, educational, or scientific.

Internal Revenue Service

A U.S. federal agency responsible for tax collection and tax law enforcement.

Museums

Institutions that collect, preserve, exhibit, and sometimes interpret objects and artifacts of cultural, artistic, scientific, or historical significance.

Federal Spending

The expenditure of government funds by federal authorities on various national programs, infrastructure, and services.

Q28: Adjusting journal entries are dated on the

Q29: Using a perpetual inventory system,the entry to

Q59: A company depreciates its equipment $500 a

Q134: Which of the following accounts would be

Q141: When using a revenue journal,<br>A)separate "Fees Earned"

Q162: Current assets and current liabilities for Brayden

Q182: If the effect of the debit portion

Q203: On the income statement,miscellaneous expenses are usually

Q205: Account used to record merchandise on hand

Q206: Prepaid insurance is reported on the balance