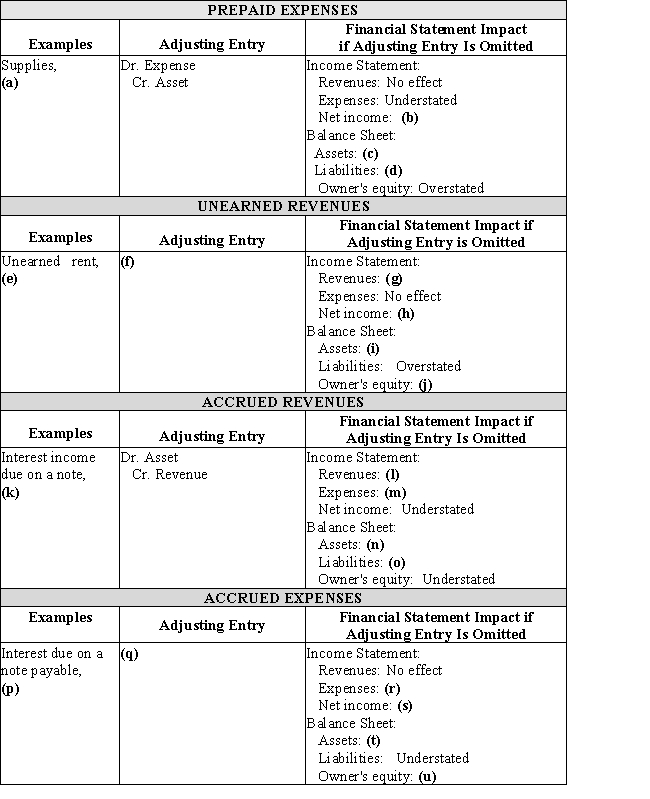

Complete the missing items in this summary of adjustments chart:

Definitions:

Federal Unemployment Taxes

Taxes paid by employers to fund the federal government's oversight of the state's unemployment compensation programs.

Withhold

To deduct or hold back a portion of something, such as taxes from a paycheck.

Take-Home Pay

The net amount of income an employee actually receives after deductions such as taxes and retirement contributions.

Voluntary Deductions

Deductions from an employee's paycheck that the employee chooses to have withheld for benefits such as retirement plans, health insurance, and union dues.

Q74: Which of the following situations increases owner's

Q91: On May 7,Carpet Barn Company offered to

Q119: The balance in the unearned fees account,before

Q130: Journalizing always eliminates fraudulent activity.

Q141: After all of the account balances have

Q160: A financial statement showing each item on

Q174: Proprietorships are owned by one owner and

Q194: Transactions are initially entered into a record

Q197: Two factors that typically lead to ethical

Q225: Balance entered in wrong column or omitted<br>A)Trial