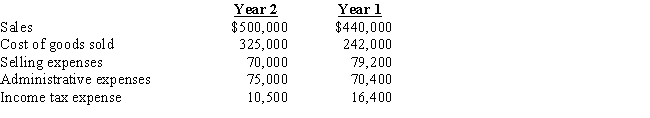

Revenue and expense data for Young Technologies Inc.are as follows:

Definitions:

Average Cost Method

An inventory costing method that calculates the cost of goods sold and ending inventory based on the average cost of all similar items available during the period.

Cost Of Merchandise Sold

The total expense of buying and preparing merchandise for sale, including the cost of the goods themselves and any additional expenses related to their sale.

Gross Profit

The amount of money a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services.

FIFO Perpetual

An accounting method where the first items placed in inventory are the first ones sold, continuously tracking inventory levels.

Q10: The cost of merchandise sold during the

Q58: If total assets decreased by $30,000 during

Q61: Journalize the following selected transactions for January.Explanations

Q92: Using the following accounting equation elements and

Q94: Repayment of long-term note payable<br>A)Increase cash from

Q102: Payment of dividends<br>A)Increase cash from operating activities<br>B)Decrease

Q116: Journalize the entries to record the following

Q131: The numerator in calculating the accounts receivable

Q144: Income tax was $175,000 for the year.Income

Q163: Decrease in accounts payable balance<br>A)Increase cash from