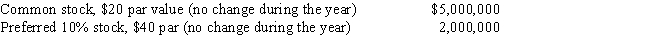

The following information was taken from the financial statement of Fox Resources for December 31 of the current fiscal year:  The net income was $600,000,and the declared dividends on the common stock were $125,000 for the current year.The market price of the common stock is $20 per share.Calculate for the common stock:

The net income was $600,000,and the declared dividends on the common stock were $125,000 for the current year.The market price of the common stock is $20 per share.Calculate for the common stock:

(a) Earnings per share

(b) Price-earnings ratio

(c) Dividends per share and dividend yieldRound to one decimal place except earnings per share,which should be rounded to two decimal places.

Definitions:

Immune System

A complex network of cells, tissues, and organs in the body that works to defend against infectious diseases and foreign invaders.

Stress

A psychological and physical response to demands or threats, which can affect mental health and overall well-being.

Suppression

The conscious deliberate attempt to push away or hide from conscious awareness thoughts, feelings, or desires deemed unacceptable or uncomfortable.

Optimist

An individual who generally believes that good things will happen and that outcomes will be favorable.

Q4: A business issues 20-year bonds payable in

Q10: The cost of merchandise sold during the

Q32: In computing the asset turnover ratio,long-term investments

Q33: Reporting unusual items separately on the income

Q50: For each of the following,determine the amount

Q75: Amortization of patent<br>A)Operating activities<br>B)Financing activities<br>C)Investing activities<br>D)Schedule of

Q85: The following data are taken from the

Q120: The numerator of the return on total

Q177: An example of an external user of

Q228: Often used as an alternative to a