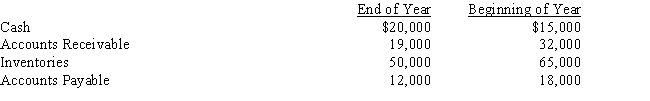

Dickinson Company reported net income of $155,000 for the current year.Depreciation recorded on buildings and equipment amounted to $65,000 for the year.In addition,a building with an original cost of $250,000 and accumulated depreciation of $190,000 on the date of the sale was sold for $75,000.Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Definitions:

Government Subsidy

Financial support given by the government to businesses, individuals, or other governmental bodies to encourage production and consumption, reduce inequalities, or support economic activities deemed beneficial for society.

Product Supply

The total amount of a product or service that is available for purchase at any given time or price.

Oil Declines

A reduction in the price or availability of oil, often due to changes in supply, demand, or geopolitical factors.

Gasoline

A highly flammable liquid derived from petroleum, used primarily as fuel in internal combustion engines.

Q27: Sabas Company has 20,000 shares of $100

Q38: The cash flows from operating activities are

Q40: A company issued $1,000,000 of 30-year,8% callable

Q56: If 800 shares of $40 par common

Q88: On the statement of cash flows prepared

Q94: The cumulative effect of the declaration and

Q103: If a firm has a current ratio

Q115: In the vertical analysis of a balance

Q145: Dollar amounts of working capital are difficult

Q157: A company reports the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6239/.jpg"