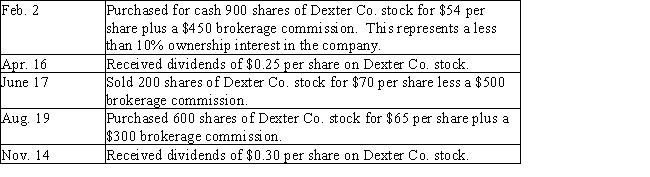

Journalize the entries to record the following selected equity investment transactions completed by Perry Company during the current year.Perry accounts for this investment using the cost method.

Definitions:

FICA Social Security

A U.S. government program funded through payroll taxes that provides benefits to retirees, disabled individuals, and survivors.

FICA Medicare

FICA Medicare refers to the portion of the Federal Insurance Contributions Act tax that is designated for Medicare, providing health insurance for individuals over 65 and some younger people with disabilities.

Gross Pay

The total amount of money earned by an employee before any deductions or taxes are applied.

Regular Rate

The hourly pay rate that is used to calculate overtime pay for non-exempt employees according to the Fair Labor Standards Act (FLSA).

Q17: Durrand Corporation's accumulated depreciation increased by $12,000,while

Q30: The journal entry Pierce will record on

Q51: On August 1,Year 1,Ant Company sold Bee

Q55: Condensed data taken from the ledger of

Q73: The current ratio is<br>A)used to evaluate a

Q95: The following data are taken from the

Q165: On the first day of the fiscal

Q173: Using the data provided for Diane Company,what

Q179: X sells to A one-half of a

Q185: If a gain of $11,000 is realized