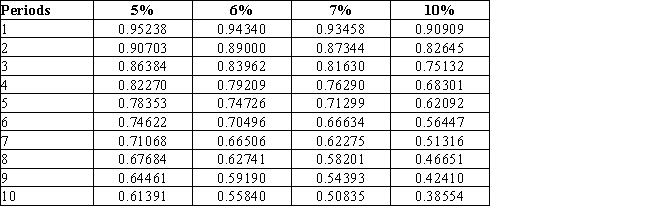

Use the following tables to calculate the present value of a $25,000,7%,five-year bond that pays $1,750

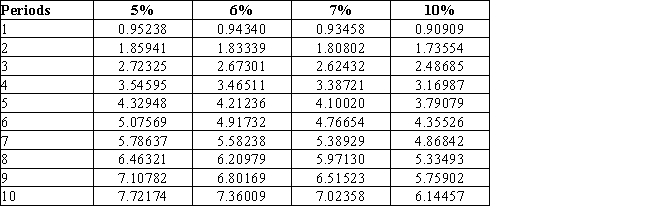

($25,000 × 7%)interest annually,if the market rate of interest is 7%Present Value of $1 at Compound Interest  Present Value of Annuity of $1 at Compound Interest

Present Value of Annuity of $1 at Compound Interest

Definitions:

Acquisition Of Inventory

The process through which a business purchases goods to be sold, which may be raw materials for manufacturing or finished goods for resale.

Collection Of Cash

The process by which businesses gather or accumulate monetary payments received from customers.

Committed Operating Loan

A loan agreement where the lender agrees to provide a fixed amount of operating capital to a borrower for a specified term.

Non-Committed

Non-Committed in finance refers to facilities or funding that is not contractually guaranteed and can be withdrawn under certain conditions.

Q16: The balance in Premium on Bonds Payable<br>A)should

Q17: Durrand Corporation's accumulated depreciation increased by $12,000,while

Q26: Bonds payable should be reported on the

Q27: Sabas Company has 20,000 shares of $100

Q30: If the contract rate exceeds the effective

Q110: Double taxation is a disadvantage of a

Q134: On the first day of the current

Q141: Using the following table,what is the present

Q161: Sabas Company has 40,000 shares of $100

Q171: Jefferson has a capital balance of $65,000