Present entries to record the selected transactions described below.

Definitions:

Rental Income

Income received from renting out property, such as real estate or personal property, which must be reported on tax returns and is subject to income tax.

Tax Year

The 12-month period for which tax is calculated. It can be a calendar year or a fiscal year, depending on the taxpayer.

Depreciation Expense

A non-cash expense that reduces the value of an asset over time due to wear and tear, ageing, or obsolescence.

Schedule E

Schedule E is a form used for tax filing in the U.S. that reports income and losses from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Q18: Xavier and Yolanda have original investments of

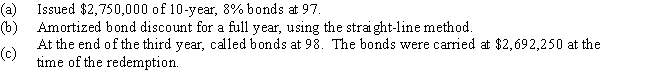

Q24: Bonds that are subject to retirement prior

Q39: If the straight-line method of amortization of

Q42: As part of the initial investment,Jackson contributes

Q91: If common stock is issued for an

Q113: Using the following table,what is the present

Q128: Federal unemployment compensation tax becomes an employer's

Q156: The income statement for Hudson Company reported

Q181: The following information is available from the

Q193: Which of the following amounts should be