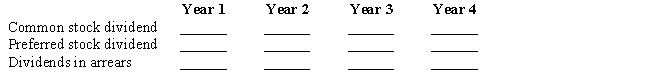

On January 1,Year 1,a company had the following transactions:Issued 10,000 shares of $2 par common stock for $12 per share.Issued 3,000 shares of $50 par,6% cumulative preferred stock for $70 per share.Purchased 1,000 shares of previously issued common stock for $15 per share.The company had the following dividend information available:  Using the following format,fill in the correct values for each year:

Using the following format,fill in the correct values for each year:

Definitions:

Divisions

Separate units or branches within a company or organization, often specializing in different products or services.

Acquiring Company

A company that purchases most or all of another company's shares to gain control of that company.

Date of Acquisition

The specific date on which an entity takes control of another entity or business, crucial for financial reporting and integration processes.

Consolidated Equipment

The aggregation of assets, including equipment, from multiple entities or divisions within a company, represented as a single total in financial statements.

Q58: Based on the following data,what is the

Q75: Which of the following is the appropriate

Q93: On the first day of the fiscal

Q103: Which of the following is not an

Q112: Federal income tax<br>A)Amount is limited, withheld from

Q136: Details of the division of partnership income

Q151: Several months ago,Maximilien Company experienced a spill

Q154: On September 1,Parsons Company purchased $84,000,10-year,7% government

Q196: The journal entry to record the cost

Q214: Which of the following statements is not