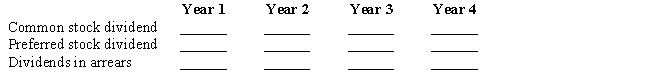

On January 1,Year 1,a company had the following transactions:Issued 10,000 shares of $2 par common stock for $12 per share.Issued 3,000 shares of $50 par,6% cumulative preferred stock for $70 per share.Purchased 1,000 shares of previously issued common stock for $15 per share.The company had the following dividend information available:  Using the following format,fill in the correct values for each year:

Using the following format,fill in the correct values for each year:

Definitions:

Purchase Order

A formal document sent by a buyer to a seller with details about a purchase, including quantities and prices of products.

Purchase Contract

A purchase contract is a legal agreement between a buyer and seller detailing the terms and conditions under which a product or property is sold.

Legal Offer

A proposal by one party to another intended to create a legally binding agreement upon acceptance.

Transformation Processes

The operations or activities that convert inputs into outputs, adding value in manufacturing or service provision.

Q8: When a stock dividend is declared,which of

Q36: A legal document that indicates the name

Q86: When compared to a corporation,one of the

Q104: During its first year of operations,a company

Q113: Macy Company has 10,000 shares of 2%

Q114: Current assets/Current liabilities<br>A)Current ratio<br>B)Working capital<br>C)Quick assets<br>D)Quick ratio<br>E)Record

Q123: When the market rate of interest was

Q167: In a defined benefits plan,the employer bears

Q195: Prior to liquidating their partnership,Craig and Jenny

Q206: Earnings per share<br>A)is the net income per