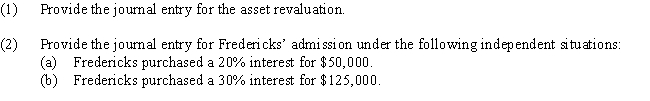

S.Stephens and J.Perez are partners in Space Designs.Stephens and Perez share income equally.D.Fredericks will be admitted to the partnership.Prior to the admission,equipment was revalued downward by $8,000.The capital balances of each partner are $100,000 and $139,000,respectively,prior to the revaluation.Required

Definitions:

Fair Value

The estimated market value of an asset or liability, reflecting what it could be bought or sold for in a current transaction between willing parties.

Compounded Semi-Annually

A method of interest calculation where the interest on the initial principal and any accumulated interest is calculated twice a year.

Future Value

The value of an investment at a specified date in the future, considering factors like interest rates and time.

Compounded Semi-Annually

Interest calculation method where the compounding occurs twice a year, impacting the total interest earned or paid on investments or loans.

Q25: Use the following information and calculate the

Q26: Probable likelihood and estimable liability<br>A)Current ratio<br>B)Working capital<br>C)Quick

Q27: If the market rate of interest is

Q29: The dates of importance in connection with

Q43: Supplies <br>(materials)used to test new equipment<br>A)Land improvements<br>B)Buildings<br>C)Land<br>D)Machinery

Q74: The amount of federal income taxes withheld

Q88: The payroll register of Seaside Architecture Company

Q111: A fixed asset with a cost of

Q164: Ulmer Company is considering the following alternative

Q208: $20,000<br>A)Treasury stock<br>B)Retained earnings<br>C)Preferred stock<br>D)Excess of issue price