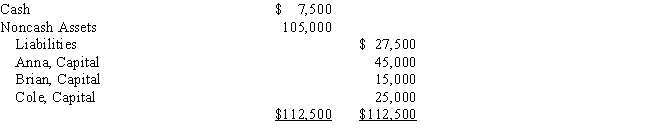

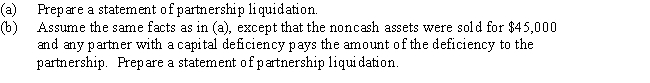

After discontinuing the ordinary business operations and closing the accounts on May 7,the ledger of the partnership of Anna,Brian,and Cole indicated the following:  The partners share net income and losses in the ratio of 3:2:1.Between May 7 and May 30,the noncash assets were sold for $150,000,the liabilities were paid,and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1.Between May 7 and May 30,the noncash assets were sold for $150,000,the liabilities were paid,and the remaining cash was distributed to the partners.

Definitions:

Prolonged Exposure

An exposure treatment in which clients confront not only trauma-related objects and situations, but also their painful memories of traumatic experiences.

Combat Veteran

An individual who has served in the military and has experienced active combat during their service.

Depersonalization Disorder

A mental disorder in which individuals feel detached from their own body and thoughts, as if they are observing themselves from outside.

Drifting

The gradual change or movement from one position, state, or condition to another, often used metaphorically to describe changes in opinions, objectives, or life circumstances.

Q1: A machine costing $185,000 with a five-year

Q13: Prior to liquidating their partnership,Samuel and Brian

Q86: Which of the following taxes would be

Q89: The limited liability company may elect to

Q94: Watson purchased one-half of Dalton's interest in

Q110: The journal entry to record the conversion

Q125: Which of the following is not a

Q131: If the partnership agreement does not otherwise

Q139: During the first year of operations,a company

Q189: Xavier and Yolanda have original investments of