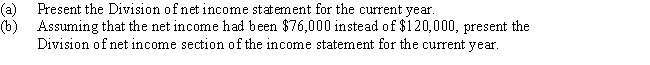

Reardon and Reese had capital balances of $140,000 and $160,000,respectively,at the beginning of the current fiscal year.The partnership agreement provides for salary allowances of $25,000 and $35,000,respectively; an allowance of interest at 12% on the capital balances at the beginning of the year; and the remaining net income divided equally.Net income for the current year was $120,000.

Definitions:

Great Deprivation

A severe lack of basic necessities or comforts of life, which can include food, shelter, and access to healthcare.

Union Density

A measure of the proportion of workers who are members of labor unions compared to the total workforce, often used to gauge the strength and influence of unions.

Union Representation

The act of a labor union standing in for its members in negotiations and discussions with employers.

Union Organization

An association of workers formed to negotiate collectively with their employer regarding wages, work conditions, and other aspects of their work.

Q38: Land acquired as a speculation is reported

Q52: Soledad and Winston are partners who share

Q57: Gleason invested $90,000 in the James and

Q115: Treasury stock shares are<br>A)shares held by the

Q122: Balance sheet and income statement data indicate

Q124: Xavier and Yolanda have original investments of

Q128: Which of the following would appear as

Q158: The return required by the market on

Q167: In a defined benefits plan,the employer bears

Q207: Accumulated Depreciation-Buildings<br>A)Current assets<br>B)Fixed assets<br>C)Intangible assets<br>D)Current liability<br>E)Long-term liability<br>F)Owner's