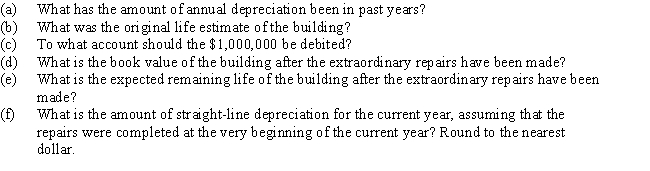

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate.The original cost of the building was $6,552,000,and it has been depreciated by the straight-line method for 25 years.Estimated residual value is negligible and has been ignored.The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Definitions:

Wholly Owned Subsidiaries

Companies that are completely owned by another company, which holds 100% of the subsidiary's shares.

International Business

The exchange of goods, services, technology, and capital across national borders, involving transactions that plan for global outreach and operational strategies.

Local Operation

The activities, functions, or processes that are carried out within a specific geographical location or community.

Multinational Corporation

A company that operates in multiple countries, managing production or delivering services in more than one country beyond its home country.

Q3: Inhaled corticosteroids are used primarily for their

Q20: An aerosol particle that is smaller than

Q24: What is the difference between an endogenous

Q42: A patient requires preventive treatment against influenza

Q43: How do resorcinols differ from catecholamines?

Q43: What basic safeguards should be followed in

Q57: A nebulizer should be placed _ back

Q59: A drug used to treat postherpetic neuralgia

Q77: When a seller allows a buyer an

Q136: On June 1,Davis Inc.issued an $84,000,5%,120-day note