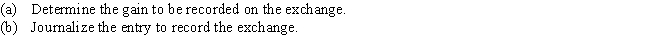

On the first day of the fiscal year,a new walk-in cooler with a list price of $58,000 was acquired in exchange for an old cooler and $44,000 cash.The old cooler had a cost of $25,000 and accumulated depreciation of $16,000.Assume the transaction has commercial substance.

Definitions:

Gain-sharing Plans

A performance-based compensation strategy where employees receive bonuses for improvements in productivity or company performance.

Fixed Formula

A predetermined method or calculation used to determine allocations, such as budget distributions or compensation adjustments, based on set criteria.

Profit-sharing Plans

A type of incentive plan that distributes a portion of an organization's profits to its employees, linking compensation to the company's financial performance.

Designing

The act of creating, planning, and executing a plan or structure for a project, system, or object with specific objectives in mind.

Q3: Gentry,sole proprietor of a hardware business,decides to

Q12: When taking several medications with an MDI,the

Q22: You are called to the emergency room

Q33: The amount of money a borrower receives

Q43: Expectorants are thought to work by all

Q130: The calculation for annual depreciation using the

Q134: Exterior and interior painting<br>A)Ordinary maintenance and repairs<br>B)Asset

Q180: The payroll register is a multicolumn form

Q183: Freight costs paid on purchase of new

Q218: Cost of insurance during the construction of