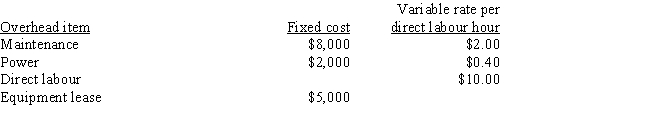

Bridgestone Company has developed the following flexible budget formulas for its four overhead items:

Bridgestone normally produces 10,000 units (each unit requires 0.10 direct labour hours) ; however, this year 15,000 units were produced with the following actual costs:

-Refer to the Figure.When using an after-the-fact flexible budget,what is the total budget variance?

Definitions:

Health Insurance Providers

Health Insurance Providers are companies or organizations that offer plans aimed at covering the costs of medical care for insured individuals or entities.

Return On Investment

A measure used to evaluate the efficiency or profitability of an investment, calculated by dividing the return of an investment by its cost.

Nearest Hundred Thousand

Rounding a number to the closest increment of one hundred thousand.

Social Security Contributions

Payments made to a government scheme that provides retirement, disability, and survivals benefits, funded through taxes on employers and employees.

Q7: Refer to the Figure.What is the fixed

Q29: On a segmented income statement,fixed costs are

Q60: Forces managers to plan<br>A)Advantage<br>B)Disadvantage

Q65: Which of the following is characteristic of

Q83: Which of the following may cause an

Q84: A production department within the factory,such as

Q93: Dynex Company had the following income

Q98: Kneeling Corporation has the following sales

Q129: Refer to Figure 14-10.Marousis Company is considering

Q147: Refer to the Figure.What is the predetermined