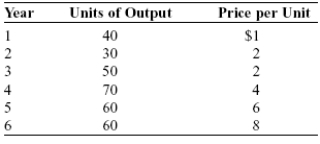

Use the following to answer questions:

Table: Real and Nominal Output

-(Table: Real and Nominal Output) Look at the table Real and Nominal Output. Assuming year 3 is the base year, real output in year 3 is:

Definitions:

Call Option

A financial contract that gives the holder the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specific time period.

Put Option

A financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Hedge Ratio

The ratio of the size of a position in a hedging instrument to the size of the position being hedged, intended to minimize risk.

Black-Scholes

A mathematical model used to estimate the price of European-style options, factoring in variables such as stock price, strike price, volatility, time to expiry, and risk-free rate.

Q8: The real wage is the wage rate

Q27: The base period for the consumer price

Q62: The price index in the base year

Q117: During a recession, one will often observe:<br>A)rising

Q126: The U.S. inflation rate was higher in

Q133: A country's GNP:<br>A)must be larger than its

Q154: (Table: Peanut Butter and Jelly) Look at

Q201: A transfer payment is a payment for:<br>A)a

Q233: The largest component of U.S. GDP is

Q344: Suppose you have estimated the supply curve