Use the following to answer questions:

Figure: Fiscal Policy II

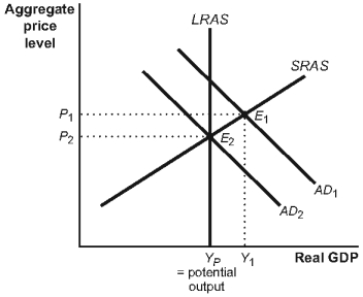

-(Figure: Fiscal Policy II) Look at the figure Fiscal Policy II. Suppose that this economy is in equilibrium at E1. If there is an increase in taxes, _____ will shift to the _____, causing a(n) _____ in the price level and a(n) _____ in real GDP.

Definitions:

Social Security

A government program that provides financial assistance to people with inadequate or no income, particularly the elderly, disabled, and families with dependent children.

Property Tax

A levy on property that the owner is required to pay, typically based on the value of the property.

Government Revenue

The income received by the government from taxes, fees, fines, and other sources, used to fund public services and obligations.

Property Tax

A tax levied by local government units on real estate based on the property's value, used to fund public services such as education, infrastructure, and law enforcement.

Q59: The Federal Reserve System was established in:<br>A)1913.<br>B)1971.<br>C)1857.<br>D)1873.

Q61: If the marginal propensity to consume is

Q69: The national debt:<br>A)is the sum of all

Q70: If there is an increase in the

Q79: When a country utilizes more physical capital

Q168: Inflation:<br>A)was very low in the 1970s and

Q200: Lyndon Johnson's tax surcharge was an expansionary

Q201: A life insurance company is a financial

Q232: Fiat money:<br>A)is currency from Italy.<br>B)can include currency

Q237: The cyclically balanced budget is an estimate