Use the following to answer questions:

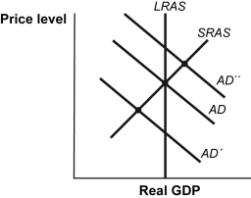

Figure: Fiscal Policy Options

-(Figure: Fiscal Policy Options) Look at the figure Fiscal Policy Options. If the aggregate demand curve is ADʺ, the most appropriate discretionary fiscal policy is to _____ government spending and _____ income tax rates.

Definitions:

Social Security Contributions

Payments made to a government scheme that provides benefits to employees and their families for retirement, disability, and death.

Payroll Taxes

Payroll taxes are levied on either employers or employees, typically based on a percentage of the wages paid by employers to their workers.

Income Tax Schedule

A chart or table used by taxpayers to determine their tax rate based on income levels, as specified by tax law.

Average Tax Rate

The percentage of income that is paid to the government as tax, calculated by dividing the total tax amount by the total income.

Q29: The U.S. dollar is an example of:<br>A)commodity-backed

Q63: Which of the following do economists view

Q90: A household's wealth is always equal to

Q108: When government spending is less than net

Q156: Suppose that Ann bought a share of

Q177: Suppose that U.S. debt is $7 trillion

Q241: Some economists have challenged the efficient markets

Q289: Domestic savings and foreign savings are:<br>A)sources of

Q347: The guarantee by the FDIC to reimburse

Q348: Alison lends $100 to Vanessa for one