Use the following to answer questions :

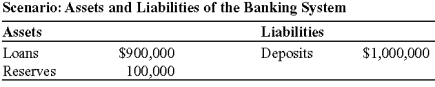

-(Scenario: Assets and Liabilities of the Banking System) Look at the scenario Assets and Liabilities of the Banking System. Suppose that the reserve ratio is 10% and the Federal Reserve sells $66,700 worth of U.S. Treasury bills to the banking system. If the banking system does NOT want to hold any excess reserves, _____ will be _____ the money supply.

Definitions:

Blank Indorsement

An endorsement on a financial instrument, such as a check, that specifies no endorsee, making it payable to the bearer.

Trust

A fiduciary relationship in which one party, known as a trustor, gives another party, the trustee, the right to hold title to property or assets for the benefit of a third party, the beneficiary.

Deposit Only

A restriction placed on a bank account, indicating that the funds can only be deposited and cannot be directly withdrawn or used for other transactions.

Restrictive Endorsements

Limiting conditions or instructions written on the back of negotiable instruments, like checks, controlling their use or further transfer.

Q61: In the short run:<br>A)only the supply of

Q90: Most of the subprime loans were made

Q127: When nominal wages increase, the short-run aggregate

Q141: When the budget is in deficit, the

Q216: An increase in the demand for money

Q239: The Reconstruction Finance Corporation:<br>A)was established to extract

Q241: If banks temporarily don't have sufficient funds

Q306: (Figure: Monetary Policy III) Look at the

Q326: The marginal propensity to consume:<br>A)is the change

Q332: (Scenario: Money and Interest Rates) Look at