Use the following to answer questions :

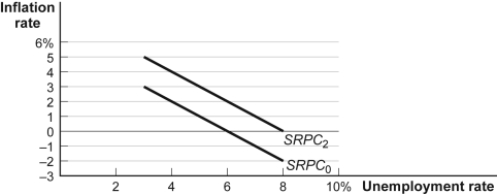

Figure: Expected Inflation and the Short-Run Phillips Curve

SRPC0 is the Phillips curve with an expected inflation rate of zero; SRPC2 is the Phillips curve with an expected inflation rate of 2%.

-(Figure: Expected Inflation and the Short-Run Phillips Curve) Look at the figure Expected Inflation and the Short-Run Phillips Curve. Suppose that this economy has an unemployment rate of 6%, inflation of 2%, and an expectation of 2% future inflation. If the central bank decreases the money supply such that aggregate demand shifts to the left and unemployment rises to 8%, then inflation will:

Definitions:

Temporary Investments

Investments not intended to be held for a long term and may include stocks or bonds, classified for easy liquidation.

Debts to Total Assets Ratio

A financial metric indicating the proportion of a company's assets that are financed through debt, assessing financial leverage.

Debt to Stockholders' Equity

A financial ratio that measures the proportion of a company's debt to the equity held by its shareholders.

Debt to Total Retained Earnings Ratio

A financial measure used to evaluate the proportion of a company's debt compared to its retained earnings.

Q4: An hypothesis that individuals base their expectations

Q50: (Scenario: The Quantity Theory of Money) Look

Q60: The long-run Phillips curve is vertical at

Q88: The short-run Phillips curve shows:<br>A)a direct relationship

Q142: Assume the money supply doubles, followed by

Q142: In the classical model, an increase in

Q175: (Figure: Actual and Natural Rates of Unemployment)

Q217: The money supply curve is:<br>A)downward sloping.<br>B)vertical.<br>C)upward rising.<br>D)horizontal.

Q235: (Figure: Classical Model of the Price Level)

Q244: If the economy is at potential output