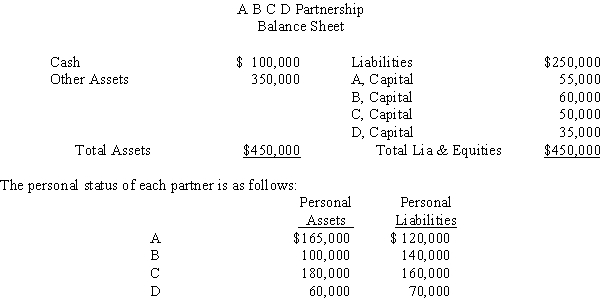

Due to the fact that the partnership had been unprofitable for the past several years,A,B,C,and D decided to liquidate their partnership.The partners share profits and losses in the ratio of 40:30:20:10,respectively.The following balance sheet was prepared immediately before the liquidation process began:

The partnership's other assets are sold for $100,000 cash.The partnership operates in a state which has adopted the Uniform Partnership Act.

The partnership's other assets are sold for $100,000 cash.The partnership operates in a state which has adopted the Uniform Partnership Act.

Required:

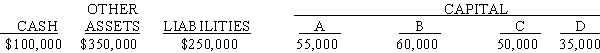

A.Complete the following schedule of partnership realization and liquidation.Assume that a partner makes additional contributions to the partnership when appropriate based on their individual status.

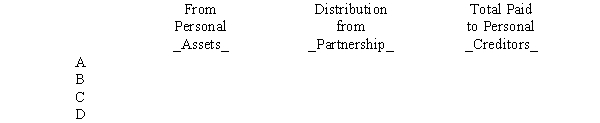

B.Complete the following schedule to show the total amount that will be paid to the personal creditors.

B.Complete the following schedule to show the total amount that will be paid to the personal creditors.

Definitions:

Materials Cost

The total expense of materials used in the production of a product, including direct materials and any additional materials necessary for production.

Conversion Costs

The combined costs of direct labor and manufacturing overheads incurred to convert raw materials into finished goods.

Weighted-Average Method

An inventory costing method that calculates the cost of goods sold and ending inventory based on the average cost of all inventory items, weighted by the quantity of each item.

Painting Department

A specific section within a manufacturing facility where products or parts are painted, typically distinguished for costing and operational purposes.

Q3: The Uniform Partnership Act specifies specific steps

Q6: The general fund trial balance for Model

Q7: Which of the following terms refers to

Q12: SFAS No.142 requires that goodwill impairment be

Q12: Dobby Corporation was forced into bankruptcy and

Q13: On January 2,2017 Cretin Co.,was indebted to

Q17: Which of the following correctly states the

Q21: At the beginning of 2017,the City of

Q22: The following account balances,among others,were included in

Q27: In the year an 80% owned subsidiary