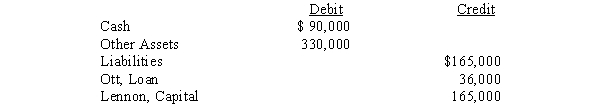

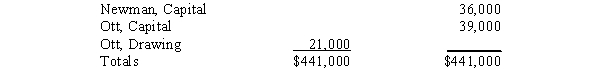

Lennon,Newman,and Ott operate the LNO Partnership.The partnership agreement provides that the partners share profits in the ratio of 40:40:20,respectively.Unable to satisfy the firm's debts,the partners decide to liquidate.Account balances just prior to the start of the liquidation process are as follows:

During the first month of liquidation,other assets with a book value of $150,000 are sold for $165,000,and creditors are paid.In the following month unrecorded liabilities of $12,000 are discovered and assets carried on the books at a cost of $90,000 are sold for $36,000.During the third month the remaining other assets are sold for $42,000 and all available cash is distributed.

During the first month of liquidation,other assets with a book value of $150,000 are sold for $165,000,and creditors are paid.In the following month unrecorded liabilities of $12,000 are discovered and assets carried on the books at a cost of $90,000 are sold for $36,000.During the third month the remaining other assets are sold for $42,000 and all available cash is distributed.

Required:

Prepare a schedule of partnership realization and liquidation.A safe distribution of cash is to be made at the end of the second and third months.The partners agreed to hold $30,000 in cash in reserve to provide for possible liquidation expenses and/or unrecorded liabilities.All of the partners are personally insolvent.

Definitions:

Tax Deductible

Expenses that can be subtracted from gross income to reduce the amount of income subject to taxation.

Home Equity Loans

A type of loan in which the borrower uses the equity of their home as collateral. These loans are often used to finance major expenses.

APC

Average Propensity to Consume, which is the fraction of income that is spent on consumption rather than savings.

Last 20 Years

Refers to the most recent two decades, a common time frame for analyzing changes and trends in economic, social, or technological domains.

Q10: On January 1,2014,Panel Company acquired 90% of

Q14: Suppose a weather forecast states the following:

Q14: On January 1,2016,Pultey Company acquired an 80%

Q22: Which of the following statements accurately describes

Q24: On January 1,2017,Roswell Systems,a U.S.-based company,purchased a

Q28: A corporation that is unable to pay

Q30: An advance cash distribution plan specifies the

Q31: All of the following are a plant

Q33: Pallet Corporation owns 90% of the outstanding

Q39: Under what circumstances might someone breathe stratospheric