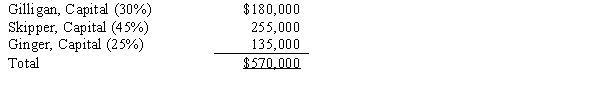

The partnership of Gilligan,Skipper,and Ginger had total capital of $570,000 on December 31,2017 as follows:  Profit and loss sharing percentages are shown in parentheses.The partnership has no liabilities.If Mary Ann purchases a 25 percent interest from each of the old partners for a total payment of $270,000 directly to the old partners

Profit and loss sharing percentages are shown in parentheses.The partnership has no liabilities.If Mary Ann purchases a 25 percent interest from each of the old partners for a total payment of $270,000 directly to the old partners

Definitions:

Annual Dividend

Annual dividend refers to the total dividend payment a shareholder receives per share of stock owned in a company over the course of a year.

Rate of Return

The outcome, whether gainful or not, of an investment throughout an established period, expressed as a percentage of the investment's purchase cost.

Annual Dividend

A financial distribution made by a corporation to its shareholders, usually once or multiple times a year, from its earnings.

Increase by

To grow or expand in value or size by a certain amount or percentage.

Q3: Greco,Inc.a U.S.corporation,bought machine parts from Franco Company

Q6: P Company purchased the net assets of

Q10: Fund entities may be classified as expendable

Q11: On November 1,2016,Jagged Company sold inventory to

Q13: A discount or premium on a forward

Q23: A trial balance for the DEF partnership

Q31: Which of the following is considered a

Q42: Referring to a weather map, which of

Q52: Which of the following is the greenhouse

Q70: Which of the following statements describes the