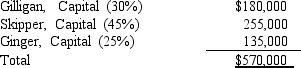

The partnership of Gilligan,Skipper,and Ginger had total capital of $570,000 on December 31,2017 as follows:  Profit and loss sharing percentages are shown in parentheses.Assume that Mary Ann became a partner by investing $150,000 in the Gilligan,Skipper,and Ginger partnership for a 25 percent interest in capital and profits and that partnership net assets are not revalued.Mary Ann's capital credit using the bonus method should be

Profit and loss sharing percentages are shown in parentheses.Assume that Mary Ann became a partner by investing $150,000 in the Gilligan,Skipper,and Ginger partnership for a 25 percent interest in capital and profits and that partnership net assets are not revalued.Mary Ann's capital credit using the bonus method should be

Definitions:

Savers

Individuals who allocate part of their income to a savings account or other forms of investment for future use, rather than spending it immediately.

Borrowers

Individuals or entities that take out loans from financial institutions or individuals, typically agreeing to pay back the original amount plus interest.

Structural Unemployment

When people are out of work for a couple of years or longer.

Textile Mill

A factory specialized in manufacturing various kinds of fabrics from natural and synthetic fibers through processes like weaving, knitting, and dyeing.

Q10: Fund entities may be classified as expendable

Q15: Contributions to NNOS include gifts of cash,pledges,donated

Q32: On January 1,2012,Panda Company purchased 16,000 of

Q32: The principal types of partnerships are general

Q33: Which of the following factors defines a

Q37: On January 1,2016,Prima Corporation acquired 80 percent

Q40: Between which of the following points is

Q41: List and describe the stages of development

Q78: What are the principal gaseous components of

Q127: What processes over southern Ontario lead to