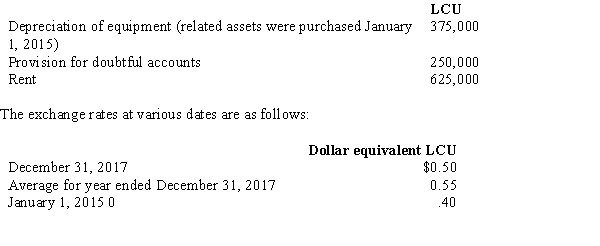

A wholly owned subsidiary of a U.S.parent company has certain expense accounts for the year ended December 31,2017,stated in local currency units (LCU) as follows:  Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year.What total dollar amount should be included in the translated income statement to reflect these expenses?

Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year.What total dollar amount should be included in the translated income statement to reflect these expenses?

Definitions:

Passive Activity

An activity in which the person involved does not actively participate or exert control, often used in reference to certain types of income for tax purposes.

Sensing

A process of receiving and responding to stimuli or input from the environment, often involving the detection of physical changes.

Nonverbal Cues

Forms of communication without words, such as facial expressions, gestures, and body language.

Interpreting

The act of explaining or providing the meaning of something, such as a word, text, or action, often in a different language.

Q3: The relationship between ethics and law is

Q9: Parr Company owned 24,000 of the 30,000

Q12: SFAS No.142 requires that goodwill impairment be

Q13: The following statement is true:<br>A)APRNs are often

Q17: Parker Company owns 90% of the outstanding

Q24: The view that only the parent company's

Q27: In the year an 80% owned subsidiary

Q29: P Corporation acquired an 80% interest in

Q32: On January 1,2012,Panda Company purchased 16,000 of

Q38: At December 31,2017,Mick and Keith are partners