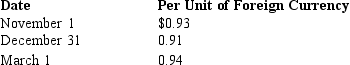

On November 1,2017,Cone Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of 250,000 foreign currency units (FCU) .On November 1,Cone also entered into a forward contract to hedge the exposed asset.The forward rate is $0.90 per unit of foreign currency.Cone has a December 31 fiscal year-end.Spot rates on relevant dates were:  The entry to record the forward contract is

The entry to record the forward contract is

Definitions:

DCF Approach

The Discounted Cash Flow approach, a valuation method used to estimate the value of an investment based on its future cash flows.

Cost of Equity

The return a company requires to decide if an investment meets capital return requirements, often calculated using the Capital Asset Pricing Model (CAPM).

WACC Calculation

The process of determining a company's Weighted Average Cost of Capital, incorporating the costs of equity, debt, and any other forms of financing.

Semiannually

Occurring twice a year, generally used in the context of payments, interest accruals, or reports.

Q8: Advertising costs may be accrued or deferred

Q10: P Company purchased 80% of the outstanding

Q11: Which of the following statements is true

Q15: Which of the following is the most

Q16: In an advance plan for installment distributions

Q25: When fresh-start reporting is used according to

Q25: Which of the following is the name

Q31: On January 1,2017,Prince Company purchased an 80%

Q34: In which of the following settings would

Q36: The following funds were among those on