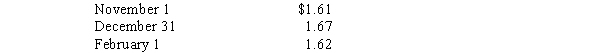

On November 1,2016,Jagged Company sold inventory to a company in England.The sale was for 600,000 British pounds and payment will be received on February 1,2017.On November 1,Jagged entered into a forward contract to sell 600,000 British pounds on February 1 at the forward rate of $1.65.Spot rates for the British pound are as follows:

Jagged has a December 31 fiscal year-end.

Jagged has a December 31 fiscal year-end.

Required:

Compute each of the following:

1.The dollars to be received on February 1,2017,from selling the 600,000 pounds to the exchange dealer.

2.The dollars that would have been received from the account receivable if Jagged had not hedged the sale contract with the forward contract.

3.The discount or premium on the forward contract.

4.The transaction gain or loss on the exposed asset related to the sale in 2016 and 2017.

5.The transaction gain or loss on the forward contract in 2016 and 2017.

6.The amount of the discount or premium on the forward contract amortized in 2016 and 2017.

Definitions:

Evidence

Information or facts that are used to support a belief, claim, or argument.

Crowdsourcing

The process of gaining information, concepts, or content by seeking contributions from a broad base of people, largely from the online community.

Fashion Business

An industry concerned with the design, production, marketing, and sale of clothing, footwear, and accessories.

Choice of Designs

Involves selecting an appropriate design or approach for a project, study, or endeavor based on objectives, constraints, and resources.

Q2: The NOR Partnership is being liquidated.A balance

Q3: The Uniform Partnership Act specifies specific steps

Q6: Constructive gains and losses from intercompany bond

Q10: On January 1,2016,Lester Company purchased 70% of

Q14: All health-care practices should develop a compliance

Q17: Which of the following patterns of air

Q20: With respect to disclosure requirements for fair

Q37: The partnership agreement of Powell,Gaunt,and Holl allows

Q38: The following balance sheets were reported on

Q50: Which of the following describes the amount