Imperial Corp.,a U.S.corporation,entered into a contract on November 1,2016,to sell two machines to Crown Company,for 95,000 foreign currency units (FCU).The machines were to be delivered and the amount collected on March 1,2017.

In order to hedge its commitment,Imperial entered into a forward contract for 95,000 FCU delivery on March 1,2017.The forward contract met all conditions for hedging an identifiable foreign currency commitment.

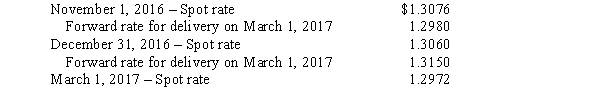

Selected exchange rates for FCU at various dates were as follows:

Required:

Required:

Prepare all journal entries relative to the above on the books of Imperial Corp.on the following dates:

1.November 1,2016.

2.Year-end adjustments on December 31,2016.

3.March 1,2017.(Include all adjustments related to the forward contract.)

Definitions:

Q6: Offsetting a partner's loan balance against his

Q8: Stiff Sails Corporation,a U.S.company,operates a 100%-owned British

Q10: How many semipermanent highs typically exist in

Q12: In accounting for expendable fund entities,revenue is

Q20: Which of the following terms refers to

Q22: Internal Service Fund billings to government departments

Q25: The defense tactic that involves purchasing shares

Q25: Which of the following is the name

Q33: Edina Company acquired the assets (except cash)and

Q33: During the second quarter of 2017,Clearwater Company