Consider the following information:

1.On November 1,2017,a U.S.firm contracts to sell equipment (with an asking price of 500,000 pesos)in Mexico.The firm will take delivery and will pay for the equipment on February 1,2018.

2.On November 1,2017,the company enters into a forward contract to sell 500,000 pesos for $0.0948 on February 1,2018.

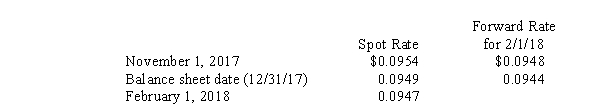

3.Spot rates and the forward rates for February 1,2018,settlement were as follows (dollars per peso):

4.On February 1,the equipment was sold for 500,000 pesos.The cost of the equipment was $20,000.

4.On February 1,the equipment was sold for 500,000 pesos.The cost of the equipment was $20,000.

Required:

Prepare all journal entries needed on November 1,December 31,and February 1 to account for the forward contract,the firm commitment,and the transaction to sell the equipment.

Definitions:

Semi-Annual

Occurring twice a year; pertaining to a period of six months.

Coupon Bond

A debt security that pays the holder a fixed interest rate, known as the coupon, usually annually or semi-annually, until its maturity date.

Present Value

The present-day value of future money or cash flows, based on a specific rate of return.

Coupon Bonds

Debt securities that pay holders a fixed interest rate (the coupon) on a periodic basis until the bond matures, at which point the principal amount is repaid.

Q14: Repayments from the funds responsible for a

Q17: On December 31,2016,Pinta Company purchased 80% of

Q22: After a head injury, what is it

Q22: The following information pertains to the transfer

Q28: Gains and losses that arise in an

Q32: The principal types of partnerships are general

Q33: Eden Company is trying to decide whether

Q35: P Corporation acquired a 60% interest in

Q38: An entity is permitted to aggregate operating

Q40: On January 1,2017,Puma Corporation acquired 30 percent