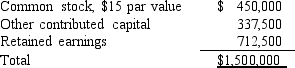

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1,2016.Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values.The stockholders' equity of Solomon Company on January 1,2016,consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2,2016.If all 7,500 shares were sold to noncontrolling stockholders,the workpaper adjustment needed each time a workpaper is prepared should increase (decrease) the Investment in Solomon Company by:

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2,2016.If all 7,500 shares were sold to noncontrolling stockholders,the workpaper adjustment needed each time a workpaper is prepared should increase (decrease) the Investment in Solomon Company by:

Definitions:

Treasury Stock

Shares that were issued and subsequently bought back by the issuing company, reducing the amount of outstanding stock on the open market.

Cash Collected

The total amount of money received by a company from its various activities, such as sales, services, or borrowings.

Customers

Individuals or entities that purchase goods or services from a company, contributing to the company's revenue.

Balance Sheet

A financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time, providing a basis for computing rates of return and evaluating its capital structure.

Q1: The following information pertains to the transfer

Q1: Under SFAS 141R,what value of the assets

Q2: The parent company concept of consolidation represents

Q10: All of the following are options for

Q11: A 90% owned subsidiary sold merchandise at

Q11: The partnership of Mick,Keith,and Charlie has been

Q12: On January 1,2016,Pent Company and Shelter Company

Q17: The duties of the trustee include:<br>A)appointing creditors'

Q18: The fair value of net identifiable assets

Q24: X,Y,and Z have capital balances of $90,000,$60,000,and