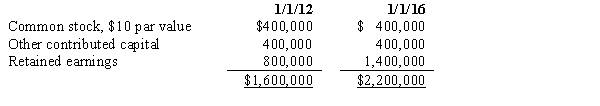

On January 1,2012,Parent Company purchased 32,000 of the 40,000 outstanding common shares of Sub Company for $1,520,000.On January 1,2016,Parent Company sold 4,000 of its shares of Sub Company on the open market for $90 per share.Sub Company's stockholders' equity on January 1,2012,and January 1,2016,was as follows:  The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is:

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is:

Definitions:

Nominal Interest Rate

The interest rate before adjustments for inflation, representing the raw rate of interest paid on savings or charged on loans.

Real Interest Rate

The rate of interest an investor expects to receive after allowing for inflation, representing the true cost of borrowing and the true yield on investing.

Nominal Interest Rate

The interest rate before adjustments for inflation; the stated or face interest rate on a loan or investment.

Q3: The Uniform Partnership Act specifies specific steps

Q4: A patient with type 2 diabetes comes

Q5: A diabetic patient asks the clinician why

Q5: Which is not a basic principle of

Q19: Poor Company filed a voluntary bankruptcy petition,and

Q21: Which of the following equations accurately expresses

Q21: Pratt Company,who owns an 80% interest in

Q32: What percentage of burns is involved using

Q34: When following the parent company concept in

Q34: Which clinical feature is the first to