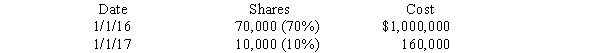

Poole made the following purchases of Smarte Company common stock:

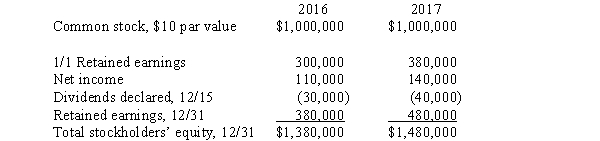

Stockholders' equity information for Smarte Company for 2016 and 2017 follows:

Stockholders' equity information for Smarte Company for 2016 and 2017 follows:

On July 1,2017,Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1,2016.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

On July 1,2017,Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1,2016.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1,2017.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31,2017.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31,2017.

Definitions:

Rolled Steel

Steel that has been processed through a series of rollers at high temperatures to achieve a specific shape and thickness.

Automaker

A company that manufactures automobiles, including cars, trucks, and other vehicles.

Straight Rebuys

Recurring purchases of the same goods or services without significant modification or consideration of new suppliers, typically routine for businesses.

Contract Negotiations

The process of discussing and determining the terms of a contract between two or more parties, aiming to reach a mutual agreement that benefits all involved.

Q3: The following balances were taken from the

Q4: On January 1,2016,Pale Company has $700,000 of

Q5: Which of the following processes removes carbon

Q11: Pointe Company purchased bonds issued by Sentient

Q15: Polish Company acquired 90% of Sandwich Company's

Q16: In the epithelialization phase of wound healing,

Q24: Bruges Electronics Inc.offers one model of laptop

Q32: It is proper to recognize revenues or

Q32: One reason a parent company may pay

Q34: Bjork,a calendar year company,has the following income