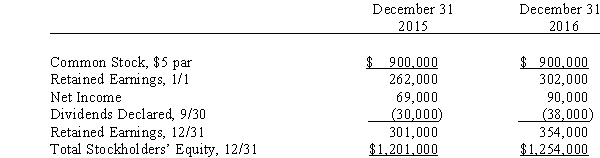

Partner Company acquired 85% of the common stock of Simplex Company in two separate cash transactions.The first purchase of 108,000 shares (60%)on January 1,2015,cost $735,000.The second purchase,one year later,of 45,000 shares (25%)cost $330,000.Simplex Company's stockholders' equity was as follows:

On April 1,2016,after a significant rise in the market price of Simplex Company's stock,Partner Company sold 32,400 of its Simplex Company shares for $390,000.Simplex Company notified Partner Company that its net income for the first three months was $22,000.The shares sold were identified as those obtained in the first purchase.Any difference between cost and book value relates to goodwill.Partner uses the partial equity method to account for its investment in Simplex Company.

On April 1,2016,after a significant rise in the market price of Simplex Company's stock,Partner Company sold 32,400 of its Simplex Company shares for $390,000.Simplex Company notified Partner Company that its net income for the first three months was $22,000.The shares sold were identified as those obtained in the first purchase.Any difference between cost and book value relates to goodwill.Partner uses the partial equity method to account for its investment in Simplex Company.

Required:

A.Prepare the journal entries Partner Company will make on its books during 2015 and 2016 to account for its investment in Simplex Company.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31,2016.

Definitions:

Q14: Polly,Inc.owns 80% of Saffron,Inc.During 2017,Polly sold goods

Q14: A 64-year-old man with type 2 diabetes

Q20: Milestones in the transition plan for mandatory

Q20: The difference between normal earnings and expected

Q21: Lyme Corporation entered into a troubled debt

Q27: On January 1,2016,BelgianAir purchases an airplane for

Q28: A parent company's equity interest in a

Q29: The liability for general obligation long-term debt

Q31: All of the following are a plant

Q39: On February 5,Pryor Corporation paid $1,600,000 for