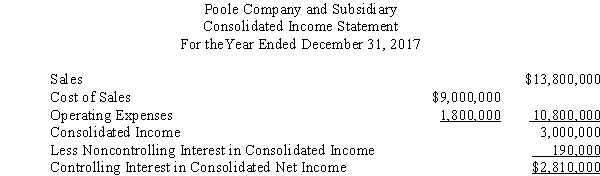

Poole Company owns a 90% interest in Solumbra Company.The consolidated income statement drafted by the controller of Poole Company appeared as follows:

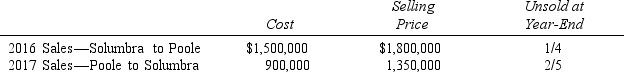

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement.Information relating to intercompany sales and unrealized intercompany profit is as follows:

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement.Information relating to intercompany sales and unrealized intercompany profit is as follows:

Required:

Required:

Prepare a corrected consolidated income statement for Poole Company and Solumbra Company for the year ended December 31,2017.

Definitions:

Face Value

The nominal or dollar value printed on a bond or a stock certificate, representing the amount due to the holder at maturity.

Straight-Line Amortization

A method of evenly spreading the cost of an intangible asset over its useful life.

Bond Premium Amortization

The gradual expense recognition over time of the premium paid above the par value for a bond.

Interest Expense

The cost incurred by an entity for borrowed funds, reflected as a charge against earnings.

Q5: A diabetic patient asks the clinician why

Q7: Which of the following are common signs

Q9: During the years ending June 30,2016,and June

Q9: Publicly owned companies are usually required to

Q12: On January 1,2016,Poole Company purchased 75% of

Q15: Which of the following signs or symptoms

Q16: Accounts are listed below for a foreign

Q18: A 60-year-old woman is seen for an

Q28: In 2017,P Company sells land to its

Q32: The principal types of partnerships are general