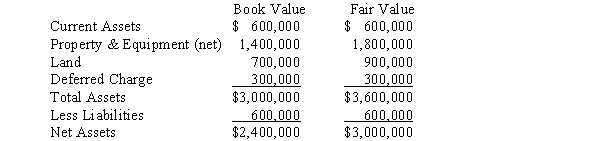

Plain Corporation acquired a 75% interest in Swampy Company on January 1,2016,for $2,000,000.The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:

The property and equipment had a remaining life of 6 years on January 1,2016,and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1,2016.Plain Company records its investment in Swampy Company using the cost method.

The property and equipment had a remaining life of 6 years on January 1,2016,and the deferred charge was being amortized over a period of 5 years from that date.Common stock was $1,500,000 and retained earnings was $900,000 on January 1,2016.Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare,in general journal form,the December 31,2016,workpaper entries necessary to:

A.Eliminate the investment account.

B.Allocate and amortize the difference between implied and book value.

Definitions:

Asset Allocation

The strategy of distributing investments among different asset categories, such as stocks, bonds, and cash, to optimize risk and return.

Investment Portfolio

A collection of various types of investments held by an individual, institutional investor, or financial institution aiming to diversify risk and achieve certain financial goals.

Asset Classes

Categories of assets, such as stocks, bonds, real estate, and commodities, that exhibit similar characteristics and behave similarly in the marketplace.

Bottom-Up

An investment approach that focuses on the analysis of individual stocks and fundamental factors affecting a company, as opposed to market-wide trends.

Q3: Oxygen has shown no benefit in alleviating

Q4: Patients require insurance counseling prior to accessing

Q9: The two basic statements prepared for expendable

Q9: A useful first step in the consolidating

Q13: On January 2,2017 Cretin Co.,was indebted to

Q14: In the consensus model for Advanced Practice

Q19: When the functional currency is identified as

Q26: Pale Company owns 90% of the outstanding

Q27: On April 1,2017,Manatee Company entered into two

Q31: Parker Company owns 90% of the outstanding