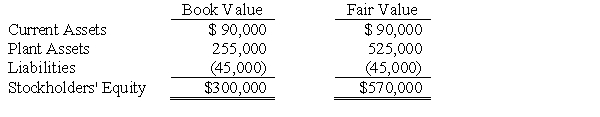

The managers of Savage Company own 10,000 of its 100,000 outstanding common shares.Swann Company is formed by the managers of Savage Company to take over Savage Company in a leveraged buyout.The managers contribute their shares in Savage Company and Swann Company then borrows $675,000 to purchase the remaining 90,000 shares of Savage Company for $600,000; the remaining $75,000 is used for working capital.Savage Company is then merged into Swann Company effective January 1,2016.Data relevant to Savage Company immediately prior to the leveraged buyout follow:

Required:

Required:

A.Prepare journal entries on Swann Company's books to reflect the effects of the leveraged buyout.

B.Determine the balance of each of the following immediately after the merger:

1.Current Assets

2.Plant Assets

3.Note Payable

4.Common Stock

Definitions:

Urine

A liquid by-product of metabolism in humans and many animals, expelled through the urinary system.

Bacteria

Microscopic, single-celled organisms that thrive in diverse environments, some of which can cause diseases.

Specimens

Samples or examples used for scientific testing or analysis.

Liquid Preparation

A form of medication that is administered in a liquid format, often used for ease of ingestion or to allow for immediate absorption.

Q2: P Company owns an 80% interest in

Q5: A parent company received dividends in excess

Q5: One of the most frequent presenting signs/symptoms

Q6: Pall,Inc,owns 40% of the outstanding stock of

Q7: According to nurse theorist Jean Watson, a

Q8: If the book value of preferred stock

Q13: P Company regularly sells merchandise to its

Q15: On January 1,2016,P Corporation purchased 75% of

Q17: Which of the following is most effective

Q29: A patient who sustains blunt chest trauma