Hopkins Company is considering the acquisition of Richfield,Inc.To assess the amount it might be willing to pay,Hopkins makes the following computations and assumptions.

A.Richfield,Inc.has identifiable assets with a total fair value of $6,000,000 and liabilities of $3,700,000.The assets include office equipment with a fair value approximating book value,buildings with a fair value 25% higher than book value,and land with a fair value 50% higher than book value.The remaining lives of the assets are deemed to be approximately equal to those used by Richfield,Inc.

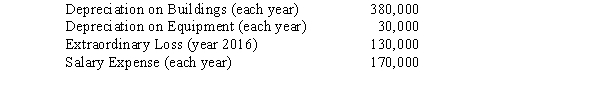

B.Richfield,Inc.'s pretax incomes for the years 2014 through 2016 were $470,000,$570,000,and $370,000,respectively.Hopkins believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future.However,it may need to consider adjustments for the following items included in pretax earnings:

C.The normal rate of return on net assets for the industry is 15%.

C.The normal rate of return on net assets for the industry is 15%.

Required:

A.Assume that Hopkins feels that it must earn a 20% return on its investment,and that goodwill is determined by capitalizing excess earnings.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

B.Assume that Hopkins feels that it must earn a 15% return on its investment,but that average excess earnings are to be capitalized for five years only.Based on these assumptions,calculate a reasonable offering price for Richfield,Inc.Indicate how much of the price consists of goodwill.

Definitions:

Multinational Corporations (MNCs)

Companies that operate in multiple countries, managing production or delivering services in more than one country.

Overseas Jobs

Employment positions located outside one’s home country, often in a different cultural or economic environment, presenting opportunities for work and travel.

Tax Avoidance

The legal usage of the tax regime to one's own advantage, to reduce the amount of tax that is payable.

Behavioral Economics

An area of economic research that incorporates psychological insights into human behavior to explain economic decision-making.

Q5: On November 1,2016,Platte Corporation,a calendar-year U.S.Corporation,invested in

Q7: P Company regularly sells merchandise to its

Q7: The main evidence of control for purposes

Q12: Mandy presents with a cauliflower-like wart in

Q12: If a portion of an investment is

Q13: Jeffrey has atopic dermatitis.You are prescribing a

Q24: The clinician is caring for Diane, a

Q28: Estimating the value of goodwill to be

Q39: On February 5,Pryor Corporation paid $1,600,000 for

Q42: The first step in determining goodwill impairment