Use the following to answer questions

Figure: Determining Surplus 3

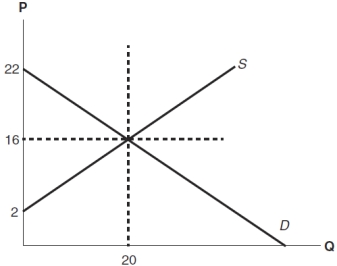

-(Figure: Determining Surplus 3)In the graph,producer surplus is $280.

Definitions:

Deferred Tax Asset

A tax benefit that arises from temporary differences between the tax and accounting treatment of assets and liabilities, to be utilized in future periods.

Income Taxes Payable

This account reflects the amount of income taxes a company owes to the government but has not yet paid, representing a liability on the balance sheet.

Income Tax Expense

The cost incurred by businesses or individuals due to earnings, calculated according to government tax rates and laws.

Pretax Financial Income

The income of a company before taxes have been deducted, commonly used in the context of reporting and financial analysis.

Q28: (Figure: Determining Surplus and Loss)In the graph,producer

Q37: Mr.Smith,who knows the proposed site of a

Q44: Joe fixes cars for a living in

Q65: (Figure: Understanding Surplus and Efficiency)In the graph,what

Q100: The deadweight loss is found by subtracting

Q106: An increase in the incomes of the

Q152: Decreased interest rates will shift the aggregate

Q214: During demand-pull inflation,the economy cannot expand beyond

Q289: If television sellers expect the prices of

Q309: (Figure: Understanding Price Ceilings and Floors)In the