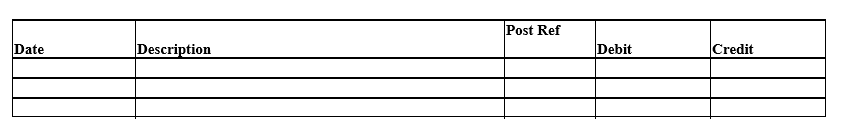

On July 1, 2010, Howard Co. acquired patents rights for $40,000. The patent has a useful life of 8 years and a legal life of 15 years. Journalize the adjusting entry on December 31, 2010 to recognize the amortization.

Journal

Definitions:

Unrealized Gains

Increases in the value of an asset that has not been sold, and thus the gain has not been "realized" through a transaction.

Comprehensive Income

The total change in equity for a business enterprise during a period from transactions and other events from non-owner sources.

Available-For-Sale Securities

Financial investments that a company holds with the intent of selling for a profit but are not actively traded or held to maturity.

Unrealized Loss

A loss that occurs on paper due to the decrease in value of an investment but has not yet been realized through actual sale or exchange.

Q3: Select the most effective method that nurses

Q21: On July 1, 2010, Howard Co. acquired

Q41: The method used to calculate the depletion

Q46: The term "receivables" includes all<br>A) money claims

Q66: If the maker of a promissory note

Q85: Fill in the missing amounts from the

Q88: At the end of a period, (before

Q108: Bank customers are considered creditors of the

Q125: If Beginning Inventory (BI) + Purchases (P)

Q132: One of the two internal control procedures