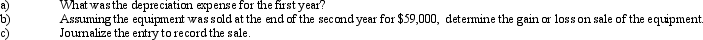

Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

Definitions:

Operating Cash Flow

A measure of the cash generated by a company's normal business operations, indicating whether a company is able to generate sufficient positive cash flow to maintain and grow its operations.

Operating Leverage

A measure of how sensitive a company's operating income is to a change in its sales volumes, reflecting the proportion of fixed costs in a company's cost structure.

Financial Break-Even

The point at which total revenues equal total costs and expenses, resulting in neither profit nor loss.

Salvage Value

The estimated residual value of an asset at the end of its useful life.

Q1: When a virus displays multiple peptide sequences,this

Q2: Which statement is not true regarding peptide

Q4: All of the following are associated with

Q7: The sum of the money on hand

Q11: Levels of transcription for a specific gene

Q39: Allowance for Doubtful Accounts has a debit

Q41: Jamison Company developed the following reconciling information

Q83: Equipment acquired on January 2, 2011 at

Q164: Inventory errors, if not discovered, will self-correct

Q170: Convert each of the following estimates of