Merchandise with a list price of $4,200 and costing $2,300 is sold on account, subject to the following terms: FOB destination, 2/10, n/30. The seller prepays the freight costs of $85 (debit Freight Out for the freight costs). Prior to payment for the goods, the seller issues a credit memo for $750 to the customer for merchandise costing $425 that is returned. The correct amount is received within the discount period. The company uses a perpetual inventory system.

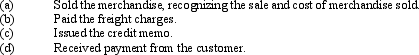

Record the foregoing transactions of the seller in the sequence indicated below.

Definitions:

Modified Accelerated Cost Recovery System (MACRS)

The system of accelerated depreciation allowed for federal tax computations.

5-Year Asset

An asset that is expected to provide economic value or service for a period of five years.

Computers

Electronic devices designed to process, store, and communicate information, playing a crucial role in both personal and professional settings.

Tax Book Value

Refers to the value of an asset or liability for tax purposes, distinguished from the actual market value or the value recorded on financial statements.

Q40: Land is an example of a plant

Q72: The units of Product Green-2 available for

Q99: In the normal operation of business you

Q121: Construct a chart of accounts, assigning account

Q139: The last custodian of the petty cash

Q155: Which one of the steps below is

Q165: Amir Designs purchased a one-year liability insurance

Q166: Which of the accounts below would appear

Q196: On March 1, a company collects revenue

Q215: Using the following information, what is the