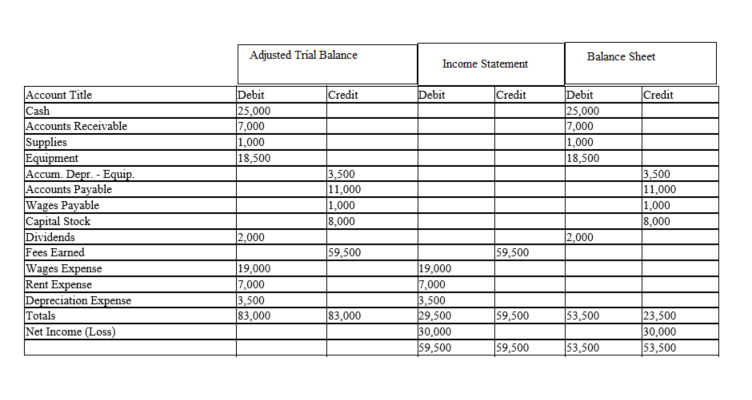

Marcus Enterprises began in 2011 when Damien Marcus invested $8,000 in exchange for capital stock. The following is the work sheet for the company at the end of the first year in business.

Marcus Enterprises

Work Sheet

For the Year Ended December 31, 2011

Prepare an income statement, retained earnings statement, and classified balance sheet for Marcus Enterprises for the year ended December 31, 2011.

Prepare an income statement, retained earnings statement, and classified balance sheet for Marcus Enterprises for the year ended December 31, 2011.

Definitions:

Certainty Equivalent Approach

A method to evaluate risk where uncertain future cash flows are converted into certain cash flows under the assumption of risk neutrality.

Risk-Free Rate

The interest rate excluding all risk premiums. The risk-free rate consists of the pure rate and an inflation adjustment. It is approximated by the three-month treasury bill rate. Written as kRF.

Real Option

The value of additional decision-making opportunities available to an investor or company once an initial investment has been made.

Financial Results

The summary of a company's financial performance and position, typically reported on a quarterly and annual basis.

Q1: Average rate of return equals estimated average

Q36: The total factory overhead for Big Light

Q57: Accruals are needed when an unrecorded expense

Q98: A work sheet heading is dated for

Q130: On January 1st, Great Designs Company had

Q148: Maxi Company's perpetual inventory records indicate that

Q153: During the closing process, some balance sheet

Q170: A net loss appears on the work

Q205: If title to merchandise purchases passes to

Q211: During the current year, merchandise is sold