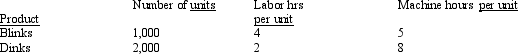

The Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

All of the machine hours take place in the Fabrication department, which has an estimated overhead of $84,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $72,000.

The Ramapo Company uses a single overhead rate to apply all overhead costs. What would the single plantwide rate be if it was based on machine hours instead of labor hours?

Definitions:

Marginal Cost

The rise in overall expenses associated with the production of an extra unit of a good or service.

Marginal Revenue

The additional income generated from selling one more unit of a good or service, crucial in determining the most profitable level of production.

Average Total Cost (ATC)

The sum of all the production costs divided by the quantity of output produced, representing the per unit cost of production.

Average Variable Cost (AVC)

The total variable costs of production divided by the quantity of output produced, indicating the average cost of producing each unit excluding fixed costs.

Q1: Use the work sheet for Finley Company

Q23: Discontinuing a segment or product may not

Q54: A company realizes that the last two

Q56: Activity rates are computed by dividing the

Q91: Activity rates are determined by<br>A) dividing the

Q95: Use the information in the adjusted trial

Q104: Lead time is the process time between

Q131: The minimum amount of desired divisional income

Q138: The net book value of a fixed

Q175: The expected period of time that will