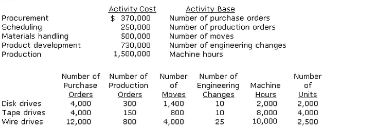

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.

Determine the activity rate for product development per change.

Definitions:

Modified Accelerated Cost Recovery

A tax depreciation system in the United States that allows the accelerated write-off of property under certain categories for tax purposes.

Tax Act of 1989

Legislation enacted to amend, revise, or change the tax laws existing at that time, specific to a given jurisdiction.

Depreciation Method

A methodical strategy for distributing the expense of a physical asset across its lifespan.

Straight-line Method

A method of allocating an asset's cost evenly over its useful life for the purposes of calculating depreciation.

Q24: Net income appears on the work sheet

Q35: If selling and administrative expenses are allocated

Q55: Tracy Roberts, the sole stockholder of Surfer

Q73: For the year ending June 30, Island

Q82: A one-year insurance policy was purchased on

Q85: The following accounts were taken from the

Q86: An 8-year project is estimated to cost

Q95: The following adjusting journal entry does not

Q109: The Stewart Cake Factory sells chocolate cakes,

Q170: The expected average rate of return for